CrowdStreet

A Detailed Analysis of the Marketing Site

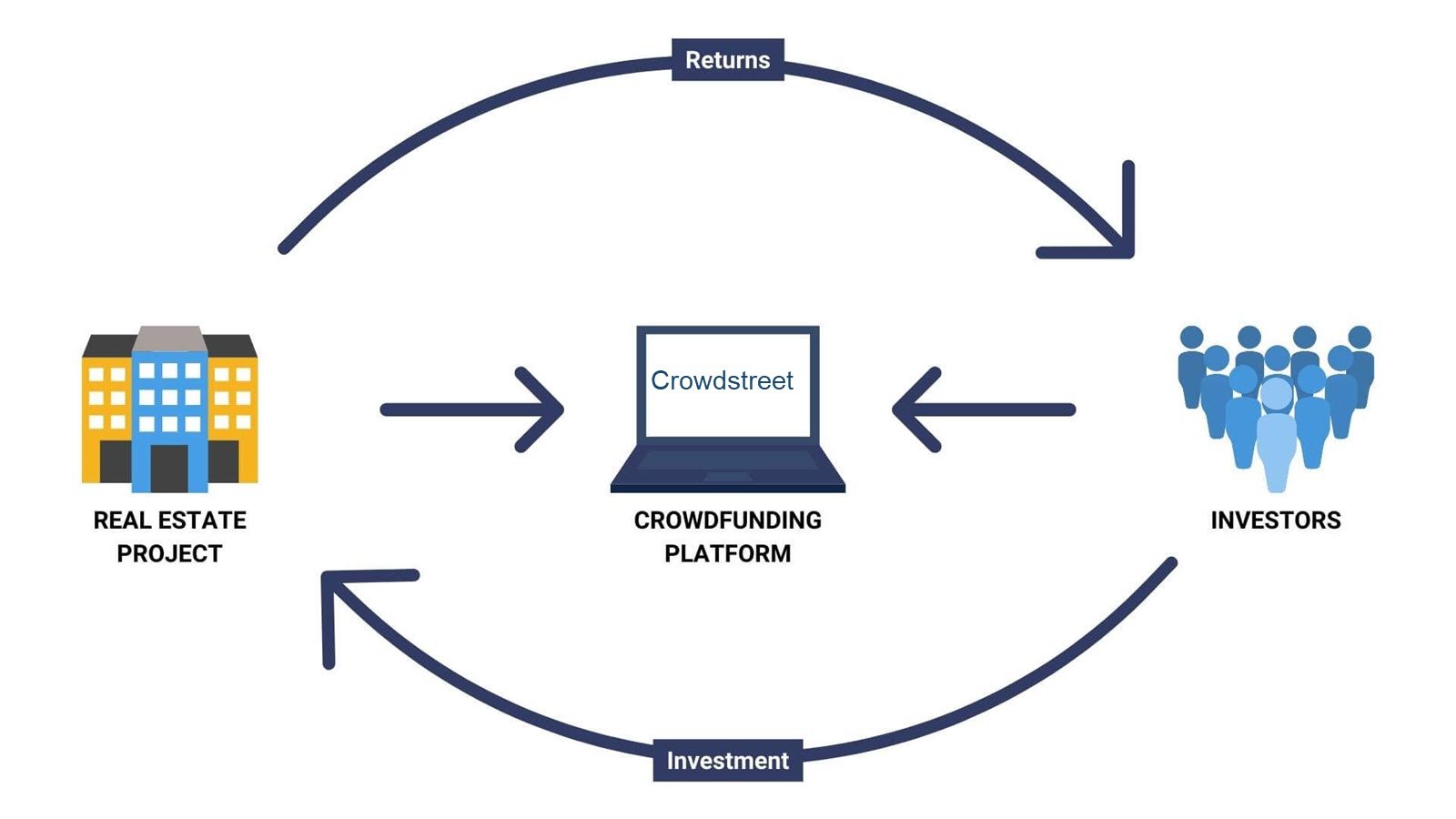

CrowdStreet is arguably one of the most established with credible brands with the residents of the United States. Established in 2014, the turning point for CrowdStreet was the success in facilitating billions of dollars in real estate transactions and funded projects giving individual investors an opportunity to invest in high-grade commercial properties which were out of their reach. The marketplace has projects that encompass but not limited to multifamily apartments, office buildings, industrial and retail development projects.

This extensive review will provide an analysis of CrowdStreet comparative markets including its site development, pricing model, features, advantages & disadvantages, trade count and number of clients as well as the unique offer that makes it different from its competition. If you would want to consider the corporate real estate market Crowdfunding model, CrowdStreet is one of the most viable options. Thus, we will examine the platform in order to assist you in determining whether it may be beneficial to your portfolio.

Background of CrowdStreet

CrowdStreet came into existence in 2014 when Tore Steen and Darren Powderly launched it from Portland, Oregon. The vision was to empower individual investors to invest directly in commercial properties that up to this date had been the preserve of institutional investors. CrowdStreet shook the world of real estate investment by opening a door to investment in commercial real estate (CRE) deals on the internet.

From the very beginning of its operations, Crowdstreet has become one of the best players in the industry and as of 2024, the platform has managed to attract investments of over $4.7 billion with more than 700 projects getting funded. The firm has built for itself an image of a responsible entity with strict procedures of due diligence and proper disclosure making it a household name in the real estate crowdfunding business.

Features of CrowdStreet

CrowdStreet has some features which make it a favorable investor option for real estate investment. Some of the key characteristics of the platform are listed below.

1. Immediate access to commercial real estate

Through CrowdStreet, investors can access institutional grade real estate offers without going through the middleman and the costs associated with that. They can invest in numerous property types including multifamily, office, retail, industrial and hospitality development.

2. Individual deals marketplace

Currently, CrowdStreet does not concentrate around pooled funds like most of the platforms but rather individual real estate projects. This not only expands the range of opportunities for investors but also enables them to adopt a more hands-on approach to their portfolios by allowing them to pick only those projects they aim at on a specific occasion, be it capital growth or income generation.

3. CrowdStreet Funds

But CrowdStreet is not only about single deals – it also offers CrowdStreet Funds, which are something like pooled investment being a diversified portfolio of real estate assets. This option is perfect for those of CrowdStreet investors that don’t want to manage things or are looking to reduce risk by investing in a number of assets. These funds are actively managed by professional investment managers who assess the projects to be undertaken depending on both performance as well as prevailing economic circumstances.

4. CrowdStreet’s Due Diligence

CrowdStreet is notorious for how due diligence is conducted on the platform. The project listing on the marketplace is only done after a thorough background check of the sponsor and the project has been conducted. Only approximately 5 percent of prospective transactions that are likely to be put on the platform do, this number explains how many deals CrowdStreet is selective about. Because it goes to such lengths, it gives the investor another layer of reassurance in the selections for investments that will be pursued.

5. Monitoring and Evaluation of Performance

CrowdStreet has detailed performance tracking and reporting tools as well as the ability to facilitate performance reports in terms of maintenance. All investors have access to the platform and they are regularly updated on key events which are usually done on a quarterly basis. All of these have been facilitated by the CrowdStreet platform which has made it easier for the clients and investors to manage so many portfolios efficiently.

6. For Accredited Investors Only

It is also worth mentioning that CrowdStreet solicits applications to accredited investors only. As per qualification requirements, an accredited investor is someone with a net worth of 1 million dollars excluding his/her primary home, or an annual income of at least 200,000 (or 300,000 for married couples).

7. Receiving Links to Webinars and Other Learning Materials

Investors also gain the access to a range of educational materials, much-need such as webinars, articles, and market reports. These resources are useful for any kind of investors whether they are embarking on investing for the first time or they are seasoned investors.

Pricing and Fees

Pricing for CrowdStreet is relatively simple but it is necessary to know how the fees work. Below is the table presenting the expenses incurred in the course of investing in the platform.

1. No Charges for Investors on Particular Deals

No individual investors suffer from charges due to platform use for investment in particular deals which constitute the greatest elaboration for CrowdStreet. Many other crowdsourcing platforms are charging investors before investing on their projects or they charge a percentage of the investment made by investors.

2. Cost for CrowdStreet Funds

Individuals who have investments in the diversified CrowdStreet’s funds are subject to both management fees and performance fees. Management fees are charged in the range of one percent and up to two percent and the performance fees range from ten percent to twenty percent of the profits depending on the particular fund. Such fees are meant to meet the expenses incurred in managing and supervising the portfolio.

3. Sponsor Fees

Although it is noted that CrowdStreet does not base a charge to the investors for individual deals, such sponsors being the developers and operators of the real estate are charged a fee by CrowdStreet for the project listing platform. Other sponsors may impose fees of their own such as the acquisition fees or management fees that are contained in the offering papers.

Pros of CrowdStreet

1. Participation on Institutional Grade Commercial Real Estate Deals

There are various opportunities where CrowdStreet investors can engage in looking for institutional grade commercial real estate deals. These projects suppose to be well researched offering various investment opportunities in various real estates sectors and different parts of the world.

2. Absence of Individual Deal Investor Fees

One of the advantages of CrowdStreet is the lack of individual project fees charged to investors for particular projects as is the norm in most real estate crowd-funding platforms. Hence, it leads to him being able to record higher net returns on investment as compared to other platforms that take higher upfront fees.

3. Transparency & Reporting

For every investment, CrowdStreet has set standard, straightforward reporting. Easily track project performance, cash distributions, and returns through the platform’s dashboard.

4. Great Diversity of Investment Choices

CrowdStreet adheres to various investment options, whether seeking appreciation in the long term or expecting regular cash flow. You can invest in single projects, or opt for CrowdStreet Funds for enhanced diversification.

5. Learning Materials

CrowdStreet does not disappoint with its range of learning materials. Be it webinars or market views, investors are able to expand their knowledge on the real estate sector and their investments.

Cons of CrowdStreet

1. All users on CrowdStreet are accredited investors

This puts a break to a number of retail investors, as it is only accredited investors who can use the platform. If you are unaccredited, there isn’t a possibility of you making investments in CrowdStreet’s deals.

2. Lack of Liquidity

Generally, real estate investments are long term and lack liquid capabilities. The majority of the deals that CrowdStreet provides usually have underlying investment holding periods of between 3 and 10 years. Investors may have to prepare themselves to lock up their funds through the investment lifetime.

3. Minimum Investments that are Quite High

Especially when it comes to Crowdstreet, we observe that for individual deals a high amount, often between $25,000-$50,000 is set. This situation may discourage a few investors who wish to spread their investments across a wider set of deals.

4. Possibility of Underperformance

Touting this system as superior is a claim that Crowdstreet has a very rigorous vetting process, and yet of course real estate investments are not risk free. Some strategies may fall short while there is always some risk of capital making pitfalls especially when the economy takes a downturn.

Number of Trades and People Who Invested

By the year 2024, Crowdstreet reported over 4.7 billion dollars worth of real estate investment transactions. It further includes about 700 real estate deals made over different states across the US. These kinds of projects can vary widely from the construction of offices to the development of multifamily and industrial constructions.

Over the past several deals, Crowdstreet has augmented its base over 200,000 and hence has become one of the largest crowdfunding real estate sites of US. Each new deal allows Crowdstreet to strengthen its position further while catering diverse and more advanced рrорertу investments to the ever expanding clienetele of accredited investors.

Types of Projects on CrowdStreet’s Crowdfunding Platform

CrowdStreet provides numerous projects of commercial real estate, thus, investors can find deals that suit their targets as well as their degree of risk. Below are some of the major categories of projects that can be found on the platform (+ potentially presenting on the platform in the future).

1. Multifamily Apartments

One of the most popular asset classes on Crowdstreet is multifamily apartments. To invest in an apartment building means the investment will bring rental income once the building has tenants.

2. Office Buildings

An office building can be expensive to construct and offices are difficult to fill, however, it is a long-lasting cash-generating asset and many investors were quick to find the long-term benefits of the investment. Thus, Office building projects on the site include new constructions as well as rehabilitations of existing properties.

3. Retail Spaces

CrowdStreet has projects involving commercial real estate in the form of retail spaces. Typically, these kinds of projects involve retailers leasing the space in their locations and can provide good returns as long as the properties are well located and managed properly.

4. Industrial Properties

Warehouses and distribution centres can also be invested in by the investors. The space requirements have significantly increased in the past few years for the industrial real estate including warehouses owing to the growth of the e-commerce sector.

5. Hospitality

Placement includes hotels and resorts in the hospitality project types on Crowdstreet. High return investments are appealing but with these benefits comes high risk investments especially when there is a recession or downturn in the economy.

Investment Returns of CrowdStreet

Since its inception, Crowdstreet has provided its investors with great returns for their investments. While factors such as deal type may disrupt the overall performance averages, a majority of projects earn investors in double digits. For instance, some multifamily projects were able to achieve annual returns of 15% – 20% while more stable industrial properties thin the finish line at 8% – Crowdstreet has consistently delivered competitive returns for investors. While performance can vary depending on the type of deal, many projects have delivered double-digit annual returns. For example, certain multifamily projects have returned as much as 15% to 20% annually, while lower-risk deals, like industrial properties, have provided steady returns in the 8% to 12% range. However, it remains only polite to stress again that previous returns reflect past performance and do not guarantee future returns, and that investments in real estate is inherently risky.

CrowdStreet vs. Other Crowdfunding Platforms

CrowdStreet vs. Fundrise

Collaboration entails working with those who share the same vision. The collaborative ventures of Fundrise and Crowdstreet come with real estate; however, they focus on different investors with varying budgets and requirements. For instance, Crowdstreet is mainly for high-income individuals, such as accredited investors that acquire specific investments in commercial real estate with a larger initial investment. Simultaneously, Fundrise makes its properties available to a wider base, trying to reach all types of investors with limited equities starting from $10.

Minimum Investment: Through Crowdstreet, a person may invest between 25,000 and 50,000 dollars into a specific project whereas the minimum amount through Fundrise is significantly less at 10 dollars.

Investment Types: While Crowdstreet specializes in specific commercial projects, Fundrise provides a more extensive selection of properties via eREITs and assorted funds.

Accreditation: Crowdstreet accreditation is compulsory while for Fundrise, non-registered investors are welcomed.

CrowdStreet vs. RealtyMogul

RealtyMogul operates similar to Crowdstreet in that it provides single asset deals as well as REITs but mainly looks to accommodate non-accredited investors who initially want less exposure. Crowdstreet is comprised more of wealthy investors looking to buy larger Commercial deals.

Retail investors can start with $5000 in REITs provided by RealtyMogul, which aims to help provide an all encompassing range of properties.

Access: RealtyMogul provides REITs for all investors while on the other hand, Crowdstreet admits only accredited investors.

Fees: RealtyMogul receives a 1 percent on the management fees of the REITs while Crowdstreet does not charge fees on single deals only on the funds.

Deal Types: Commercial property investment is more extensive in Crowdstreet offerings while RealtyMogul concentrates on multifamily and small commercial deals.

Conclusion

CrowdStreet has positioned itself as the top of the line real estate crowdfund which offers the best institutional grade commercial real estate deals. Given their high level of support, due diligence, reporting, and effort to provide investment alternatives, Crowdstreet is most ideal for accredited investors whose investment goal is diversifying their portfolio through real estate.

Still, the relatively low liquidity of the investment and a high minimum required investment may cut off potential investors from the market. Say, if illiquidity is not an issue for you and you can afford this high threshold, Crowdstreet may provide great returns with exposure to great properties.

Having over 200 million investors as well as 4.7 funding, Crowdstreet keeps growing its offering making it still a reliable name in the real estate crowdfunding industry. Crowdstreet offers an elegant solution to this type of investors looking to incorporate real estate to their portfolio through a very clear and effective template.