Beginners Guide in Investing in Stocks

Investing in the stock market can feel overwhelming, especially for new investors like you. In this Beginner’s guide to investing in stocks, we will break down actionable steps to help you spot and find good stocks. You’ll learn how to analyze financial health, assess market trends, and identify potential winners in your portfolio. Avoid common pitfalls and equip yourself with insider knowledge as you look into the exciting world of stocks. So, let us get started on your journey with this Beginners guide in investing in stocks and set the stage for future success!

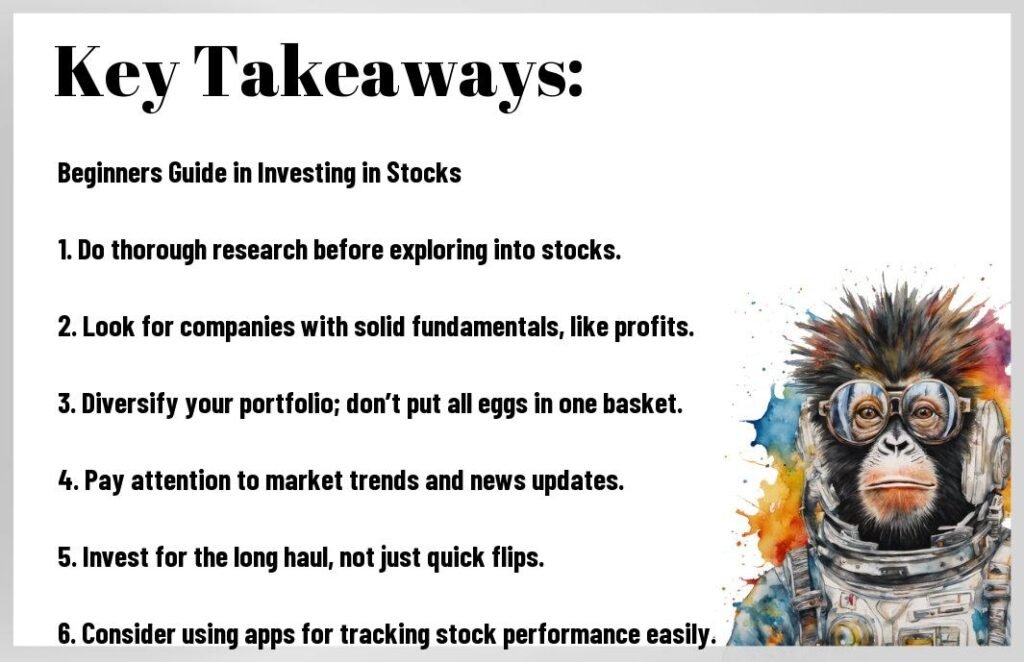

Key Takeaways:

Research: When submerging into the stock market, knowledge is power! Spend time looking into the companies you’re interested in. Check their financial health, recent news, and future prospects. The title ‘Beginners Guide in Investing in Stocks’ emphasizes that doing your homework can save you from a rookie mistake.

Diversification: Don’t put all your eggs in one basket, as the saying goes. Spread your investments across a variety of sectors. This way, if one area takes a nosedive, your other stocks can soften the blow. The title ‘Beginners Guide in Investing in Stocks’ suggests that a well-rounded portfolio can pave the way for steady growth.

Patience: Investing is not a get-rich-quick scheme. Good things come to those who wait! The market has its ups and downs, but a well-selected stock can blossom over time. The title ‘Beginners Guide in Investing in Stocks ‘ highlights the importance of being patient and staying the course, especially during turbulent times.

In your journey as a new investor, utilizing this ‘Beginners Guide in Investing in Stocks’ will help you navigate the often murky waters of the stock market. While it may seem overwhelming at first, keep these takeaways in mind! Happy investing, and don’t forget—every expert was once a beginner.

Understanding the Stock Market

While submerging into the world of investing can feel overwhelming, grasping the fundamentals of the stock market is key to building your financial future. You will find that the market operates like a bustling marketplace where buyers and sellers come together, offering a plethora of opportunities for you to explore and profit from.

What is a Stock?

Stocks represent a share in the ownership of a company, giving you a claim on its assets and earnings. When you purchase a stock, you are vitally buying a piece of that company, allowing you to participate in its growth and profit sharing.

How the Stock Market Works

Before getting your feet wet, understanding how the stock market operates is vital. The stock market is made up of exchanges like the NYSE and NASDAQ, where stocks are bought and sold. Prices fluctuate based on supply and demand, influenced by various factors like company performance, economic conditions, and investor sentiment.

Considering how the stock market works, you should be aware that it functions as a reflection of the overall economy. Market fluctuations can be rapid, driven by news, earnings reports, and global events. This means that while there are plenty of opportunities to make money, there’s also a risk of losses if you are not aware of the underlying factors affecting stock prices. Keeping a close eye on market trends, and doing your due diligence can help you navigate this exciting terrain with confidence.

Setting Investment Goals

Some investors jump into the stock market without a clear plan but setting well-defined investment goals is key to navigating this complex terrain. Determine what you want to achieve. Saving for retirement, funding a child’s education, or purchasing a home. Your objectives will shape your strategy, influencing the types of stocks you consider and the timeframes in which you expect to see returns. A focused approach not only guides your choices but also helps you stay disciplined in the ever-changing market landscape.

Short-term vs. Long-term Investing

One of the first decisions you’ll face in your investment journey is whether to engage in short-term or long-term investing. Short-term investing often involves buying and selling stocks within a few months, capturing gains from price fluctuations. On the other hand, long-term investing focuses on holding onto stocks for several years, benefiting from compounding growth and dividends. Understanding your investment style will assist you in curating a portfolio that aligns with your financial goals.

Risk Tolerance Assessment

To effectively invest, you need to assess your risk tolerance. This involves evaluating how much risk you’re willing to take based on your individual circumstances including your financial situation, investment goals and emotional response to market fluctuations. It’s imperative to align your investment choices with your comfort level, as this helps prevent panic selling during market downturns.

Another important aspect of assessing your risk tolerance is understanding that it can change over time. As you gain more investing experience or as your financial situation evolves, your willingness to accept risk may shift. Think about your current lifestyle and life stage. Young investors might be more open to risk for potential higher returns while those nearing retirement may lean towards safer investments. Ultimately, knowing where you stand on the risk spectrum is a fundamental part of your overall strategy in setting investment goals and moving forward confidently in the world of stocks.

Researching Potential Stocks

Many new investors find that researching potential stocks can initially feel overwhelming, but breaking it down into manageable steps can lead you to smart investment choices. Begin by identifying industries or companies you are interested in and then probe their financial health and market position. Tools like stock screening websites can help you sift through options. Don’t forget to stay updated on news and trends that may impact stock prices—your success hinges on informed decisions.

Fundamental Analysis

About fundamental analysis, this method involves evaluating a company’s financial statements, such as income statements and balance sheets, to judge its overall health. You place a significant focus on metrics like revenue growth, profit margins, and debt levels. By comparing these figures against industry peers, you can uncover undervalued stocks—ones that have the potential for growth as their true value is recognized by the market.

Technical Analysis

Between fundamental analysis and technical analysis the latter focuses on price movements and trading volume to gauge stock performance. It involves using charts and various indicators to predict future movements based on past trends. This can help you identify entry and exit points, giving you an edge in timing your investments right.