How to Use TradingView to Boost Your Investing Game

Being able to put data to good use, see trends, and act accordingly are important for successful investing. Because the financial sector moves so quickly, investors now require tools that are complete, strong, and intuitive. It is well-known that TradingView has more features compared to most other platforms for private investors. TradingView helps both new and experienced traders to make more informed, quicker, and stronger investment decisions.

The purpose of this article is to show you how to use TradingView to improve your investing experience. Together, we’ll explore the features, tools, and what the community shares, and you’ll learn how to use its many abilities.

Getting Familiar with TradingView’s Layout

The first thing you see on TradingView is the crisp and streamlined design. Things are organized on the page to allow users to work without being distracted and to use the site effectively. There are customizable windows for charts, a toolbar at the top for the main functions, and a sidebar showing your watchlist, alerts, and ideas.

TradingView is seen as one of the best free apps for private investors because it combines real-time numbers, in-depth analysis, and a personalized interface all together. It doesn’t immediately confuse you, but it has a lot to offer once you want to bring it to the next level.

Creating a Free Account

Getting the full benefits from TradingView requires registering a free account. When you register, you can keep layouts of charts, curate watchlists, and talk with other users. It even allows you to set notifications and look at different indicators. Retail investors will find that the free version of TradingView is quite strong.

You are able to set up charts in many ways and save each layout for choosing various trading strategies or markets. Just having real-time market updates and a custom dashboard will make investing more efficient, even if you’re just doing it now and then.

Choosing Your Preferred Market

A major benefit of TradingView is that it works well with many markets. You can view charts and information on stocks, global equities, cryptocurrencies, foreign exchanges, and commodities anywhere in the world using TradingView.

It is possible to go between different exchanges, review tickers that trade across markets, and check how world trends might impact your holdings. If you plan to experiment and balance your strategies, multi-asset help is very important for controlling risks.

Using Technical Analysis Tools

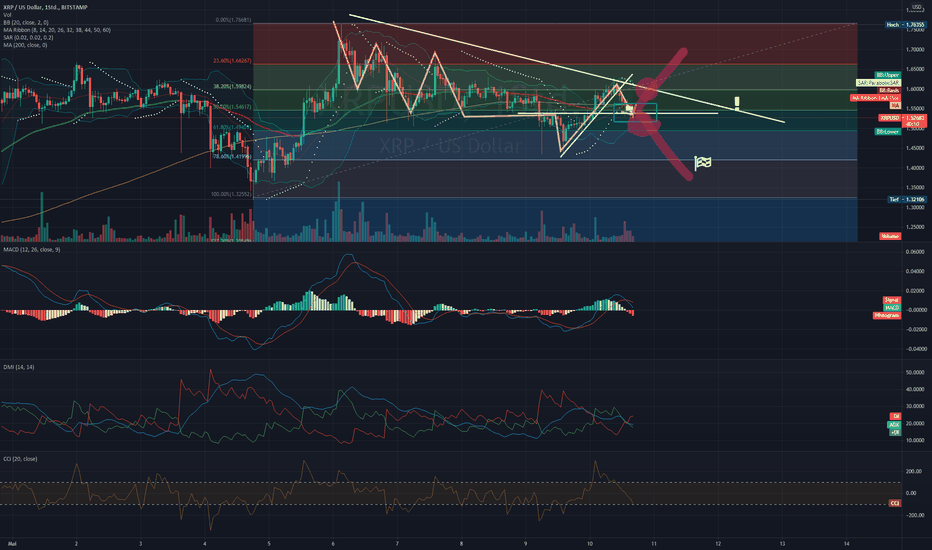

TradingView’s charting engine forms the heart of why it is successful. Assets can be seen on charts in the form of candlesticks, bars, or lines, and numerous technical indicators can be used as well. Cryptocurrency trading platforms simplify using technical analysis tools like moving averages, RSI, MACD, and Fibonacci retracements.

It is possible to use the platform to plot support and resistance, notice price channels, and combine various indicators on one graph. You can personalize everything, which makes your trading experience match your style.

Creating and Using Watchlists

It’s straightforward to keep an eye on your portfolio or search for new chances with TradingView’s watchlist. You can add any company ticker to a list and view their prices, trading volume, and other important metrics as it happens. You can make watchlists based on different sectors, asset types, or your current strategies so you can concentrate on the right things.

The structure is one of several features that make TradingView a noted free trading app for private investors. Without making your ability to work with data complex, it makes it easier to manage your data.

Setting Alerts to Stay Ahead

You need to respond fast when the market offers an opportunity to be successful. Setting up alerts in TradingView is possible using the conditions you set. You have the option to set up alerts for things like price levels, volume changes, or when one indicator crosses another, and you can receive those alerts by email, alert in the app, or SMS.

Because of this, you can take breaks away from your phone freely. The platform will give you info when the market hits the level you are watching. It’s almost the same as having someone watching the stock market on your behalf.

Exploring Community-Shared Ideas

Many people underestimate that TradingView’s strongest, most powerful asset is its user community. Each day, people post their thoughts, analyses, and charts on trading and investing. You are able to follow those who post, join in conversations, and benefit from hearing multiple viewpoints.

Since this approach depends on the group, you can confirm your approaches or think of different ones. Both conservative and aggressive investors can gain insights from learning how people view market trends.

Customizing Charts for Better Clarity

It is important to understand market data clearly. TradingView gives you the ability to customize your charts in every way. You may change the color of your chart, adjust candle size, modify how parts of the layout are arranged, and store templates. They are very helpful if you constantly keep an eye on several timeframes or try different things in each asset.

Having well-maintained and presentable charts cuts down the effort needed to judge trends and eases the decision-making process. For people who trade on their own, being able to adjust charts visually is very helpful.

Using Pine Script to Build Your Own Indicators

People who are advanced users can make use of TradingView’s own scripting language called Pine Script. With Pine Script, you are able to design custom indicators, strategies, and backtests. If you have always hoped to make a tool that serves your needs exactly, now is the time.

You do not need to be a coder by profession. The language has a simple design and detailed documentation. Because of community feedback and pre-made templates, anyone with intermediate knowledge can design tools that assist them in investing.

Backtesting Strategies with Historical Data

It is important to first test your concepts before taking them to the market. Backtesting strategies using TradingView starts by analyzing historical data. With this, you can observe how your indicators fare when the market changes.

You can find mistakes in your beliefs, perfect your points to buy and sell, and develop a strategy using real data. Being able to backtest the software directly on the platform draws more attention to TradingView as one of the top free apps for retail investors who are data-driven.

Linking TradingView with Brokerage Accounts

Although TradingView isn’t a brokerage itself, it links its users to a number of main brokers. After connecting, you may buy or sell from your charts, making the process from checking to trading smooth.

With this, users don’t have to switch between apps and can lower the chance of slow trade execution. Combining the tools for analysis and trading in one place greatly helps people invest effectively.

Using the Economic Calendar to Time Decisions

News and major happenings in the economy can cause markets to react. An economic calendar on TradingView shows when new data, announcements from central banks, and company earnings are due.

If you display your order book within your chart, you can get ready for prospects of higher volatility or new chances. Knowledge of approaching important events helps you decide when is the best time to execute your decisions.

Mobile App for On-the-Go Investing

Modern investors are looking for flexibility. Most of the features found on the desktop version are also available in the mobile app, which is set up for smartphones and tablets. You can access charts and watchlists, act on alerts, and connect with the community from anywhere with your mobile phone.

Because trading is mobile, you don’t have to worry about missing any opportunities when you are away. If you’re stuck in traffic, taking a train, or having off hours, your investing skills are unaffected.

Educational Content to Strengthen Your Skills

Blog posts, how-to guides, video tutorials, and live streams are among the educational materials available on TradingView. New users can start by learning the basic concepts, whereas experienced investors have a chance to explore things like algorithmic trading or the psychology of the market.

To become a better investor, education is very important. TradingView helps you continue learning so you can stay ahead in the market at all times.

Making the Most of TradingView’s Free Version

You do not need a paid plan to make TradingView work for most things as a retail investor. You are able to use live data, charts, alerts, and posts from others without paying anything.

People often say the platform is among the top free apps for private investors because it is so easy to use. It allows people to start whenever and without hurdles that hold them back.

Conclusion

TradingView stands out by giving simplicity, even in a world where financial options are becoming more difficult to understand. If this is your first hunt or you focus on improving, it gives you the crucial tools, knowledge, and backup of others to inform your final decisions.

The best free apps meant for private investors go beyond tracking prices and offer a full experience. You use TradingView to review, decide, try, and put your ideas into practice. It means you can learn to improve your strategy and feel better about the decisions you make.

If investing is serious to you, having this platform is necessary. Examine what it offers, meet with others in the community, and rely on it for help in managing your finances. Beyond making investing easier, TradingView helps you become a stronger investor.