How to Use Candlestick Patterns in Stock Trading

Candlestick patterns are among the most helpful tools in stock trading. They help traders get a brief view of the market’s current state, besides likely price movements, for technical and business purposes. Candlestick charts show stock costs and trends in a given period by portraying opening and closing prices and higher and lower prices. These price patterns help the trader meet future expectations of price levels. That is why learning how to use candlestick patterns to optimize trading is highly advisable.

In this article, the author will endeavor to highlight the relevance and significance of candlestick patterns in stock trading, classify various patterns, and elaborate ways of trading using these outstanding patterns.

Understanding the Basics of Candlestick Patterns

Candlestick pattern involves a group of one or more individual candlesticks in which each candlestick represents a different time period called time frames, such as day-week or hour-week. Each candlestick has two parts: the body and the wick (or the shadow). The body is the rectangle’s width from the opening and closing prices, and the wick illustrates the extreme prices in the period. The color of the body makes it distinguish whether the stock price has gone up or down. Traditionally, green or white means closure at a higher price than the opening, while red or black means closure at a lower price level than the opening.

Candlestick patterns are available as single-candle patterns and multiple-candle patterns. These patterns could represent a reversal, continuation, or consolidation in the market, allowing the trader to guess the next likely movement of prices.

Bullish and Bearish Candlestick Patterns

Candlestick patterns can be classified into two broad categories: bullish and bearish. Bullish patterns in charting suggest that the price of a stock is likely to increase, while bearish signals indicate that the price is likely to decrease. It is important for any trader to understand the concept of these two types of patterns because they help him predict future price volatility and adapt his trading strategy.

For instance, the bullish engulfing pattern, where a small red candle is followed by a green candle, indicates that buyers are gradually taking control of the market, thereby giving a bullish signal. On the other hand, the bearish engulfing pattern, identified by a big red candle succeeding a small green candle, looks likely to provoke a bear market.

Reversal Candlestick Patterns

Reversal trading patterns are believed to point to the possibility of alteration in stock prices’ trends. Such patterns are rather significant since they may help the trader distinguish between the end of a given trend and the start of a new one. The reversal patterns that exist include hammer, hanging man, and engulfing patterns.

For instance, one of the hammer patterns is established when a small body with a long lower wick is identified after a downward movement. It indicates that bearish pressure is being reduced, while buying pressure may gain the upper hand in the near hull, which may prove a reversal upwards. On the other hand, the hanging man pattern is similar but formed after an up movement, suggesting that the prices might reverse down.

Continuation Candlestick Patterns

Another type of pattern we find is continuation, which indicates that the present trend will persist. Such patterns are beneficial to traders who do not intend to exit the trade market soon as they help traders affirm the power of the current trend. The rising three methods and the falling three methods are some of the most widely used continuation patterns.

The pattern of the rising three methods is a long green candle with a series of small red candles right after in an upward trend environment. The pattern ends with one more long green candle, which supports the continuation of the uptrend. The pattern of the falling three methods contrasts with patterns that indicate the continuation of a downward trend.

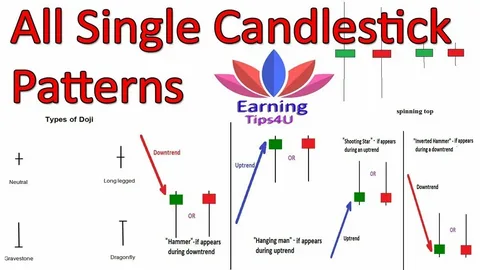

Single-Candle Patterns

Single-candle patterns are easy to read, and sometimes, you may get a lot of information from single-candle patterns. Several known single-candle patterns comprise the doji, spinning top, and marubozu.

A doji is an occasional pattern characterized by a very small or non-existent body; the opening and closing prices of a stock are virtually equivalent. This pattern suggests reversal, and if formed after a clear directional trend has developed, it is a confirmation. The spinning top is similar, but the body is compact, and the wicks are longer, meaning that buyers and sellers are involved, but no one has the upper hand.

The marubozu pattern, unlike the others, lacks a wick, indicating that the stock opened at its high or low and closed at the exact opposite. A marubozu candle with an upward tail suggests that there was buying pressure, while a marubozu candle with a downward tail suggests that there was selling pressure.

Multi-Candle Patterns

Multi-candle patterns involve two or more candlesticks and are considered to have a better indication than single-candle patterns. The engulfing pattern described above is an example of a multi-candle formation. The morning and evening stars are parameters in multi-candle patterns.

A morning star forms after a downtrend and consists of three candles: A long red candle, a small-bodied candle associated with uncertainty, and lastly, a long green candle. This pattern implies that the bearish trend may be over soon, and a return to the bull trend could happen next. Oppositely, the evening star is when there is a bearish indication after a rise in the number of candles.

Using Candlestick Patterns with Other Indicators

Therefore, although several candlestick patterns offer strong analytical signals, their use is more advisable when combined with other technical tools. Candlestick analysis is usually used in conjunction with technical tools like moving averages, RSI, or support and resistance levels to validate signals.

For instance, a trader may identify a bullish engulfing pattern with a price; however, that will only begin trading after the price has violated the above-barrier resistance. Likewise, if one finds a bearish candlestick formation near the resistance level, then one can confirm that the price will probably pull back and move down.

Time Frames and Candlestick Patterns

Most candlestick patterns can be used on one-minute candles, five-minute candles, 30-minute candles, hourly candles, four-hour candles, daily candles, weekly, or even monthly charts. The trading period depends on the desired trading mechanism and the traders themselves. Intraday traders will look at charts on the hour or for the day, while positions looking for longer-term hold can look at weekly or monthly charts to identify these patterns.

All these considerations must be considered because, generally, candlestick patterns are more predictable in higher time frames. Cues that appear on the daily/weekly chart are expected to be more meaningful than those traced in the five-minute chart. However, a shorter time frame is helpful to traders by providing them with entry and exit prospects within short spans.

Avoiding False Signals

Similar to any other technical analysis indicator, the candlestick patterns have their limitation. Misleading signals could arise at times, rare but could be rife during periods of high risk, such as during the onset of a financial crisis or periods of low stock market turnover. As illustrated throughout this article, this is the best way to avoid being carried away by false signals; it is recommended that traders employ other indicators, such as the volume chart or trend line.

One should also wait and then wait some more before entering trading on the basis of a candlestick pattern. For instance, a bullish reversal may be observed after a down move, but when the price fails to move above the bull channel, it will not follow through as a reversal pattern.

The Importance of Practice and Experience

It is also important to learn when to employ specific candlestick patterns in trading or investments because this is not a straightforward skill. New traders are advised to begin trading by first identifying the major chart patterns and then studying the effects of these patterns observed in the real world. Using a demo account, one can gain confidence and make decisions without risking actual money on candlestick patterns.

While trading, patterns are likely to be discovered, and as the trader becomes more experienced, they will be able to identify them amidst the market information. In the long term, this should lead to higher accuracy and better performance when trading.

Building a Trading Strategy Around Candlestick Patterns

Candlestick patterns can form a complete trading system on their own, but this should not be encouraged. Thus, successful traders develop trading strategies using analysis, such as trends, support and resistance levels, and indicators, including moving averages.

For instance, a trader may use candle patterns to look for signal points; at the same time, he may use trend lines and moving averages to look at the overall trend of the market. Such a combined approach contributes to increasing the effectiveness of trading signals and minimizing the production of false signals.

Staying Updated with Market News

However, like all indicators, they lack the context of factors affecting the market: news, indicators, presidential speeches, or companies’ earnings releases. Every trader ought to be alert to market information that may cause changes in the specific stock being traded.

For example, a bullish candlestick pattern may occur just prior to an earnings announcement that reveals negative numbers for a corporation, which in turn causes the price of the stock to plunge. Indeed, merely noting such occurrences hampers traders from making ponderous mistakes.

Conclusion

Candlestick patterns are one of the most effective tools for stock trading that can help users anticipate the general trend of the market, extreme fluctuations, and trend reversals. When combined with other known technical analysis tools, pattern analysis can improve the trader’s efficiency and enable the trader to make better decisions about the securities they wish to trade. However, as we know, no technical tool is infallible; thus, candlestick patterns must be given good attention and used cautiously. He further buttressed his opinion that traders using candle sticks with other charting forms, those who study the market news, and those with a lot of patience for the practice and business will be better off in the stock market.